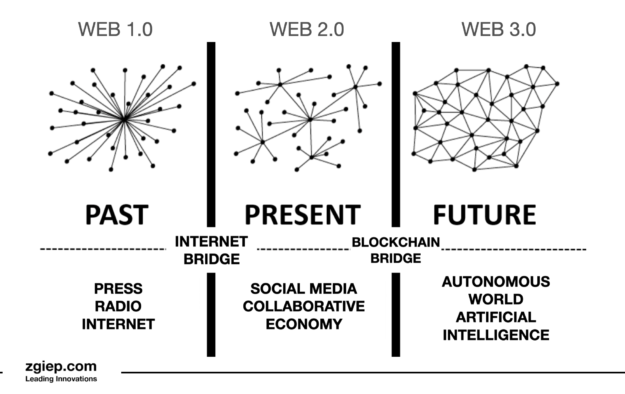

From Web1.0 to Web3.0.

The technological development of the world is constantly accelerating. Various technologies continuously improve the quality of our lives, eliminate systemic irregularities, and enhance work efficiency. Today, technology is present in virtually every sphere of life. In the vast majority of cases, technology brings added value to humanity. However, it also happens that with the advancement…