Many people come to me with proposals of interesting investment projects, some of them, however, are presented in an inaccessible form, so there is a risk that they will not be properly received. From the investor’s point of view, time matters, so if the information provided in the presentation is not precise enough, the chance of my interest in your project drops drastically.

A Pitch deck is the first step on the way to get/attract an investor. In my case, it is a preliminary/introductory “meeting” with you, which is supposed to convince me that your project has potential and it is worth attracting other investors to it.

Your task is to quickly and specifically show that the idea offered by you is so innovative and interesting, that it will bring high income with the lowest possible risk. It is important to present the idea and nature of the product – in addition to specific data, I hope that you will show me how it can realistically improve reality.

Now it’s time for some technical details. Your presentation (has to describe itself/tell about itself – send it to my email address (lukas@zgiep.com) in a PDF file. Looking through it should take me about 3-4 minutes. Despite this, you cannot overdo the content, you should avoid small fonts, large portions of text, bullets – it is best to replace them with keywords. The pitch deck is supposed to stimulate the imagination – graphics, charts and photos will be helpful to verify your idea. Keep one graphic style, so that everything is consistent and easy to follow. You can use pre-defined templates, for example Improve Presentation.

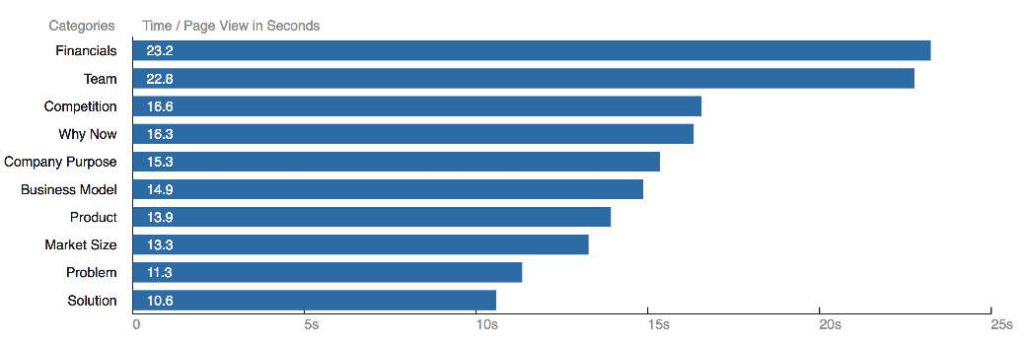

Below I present to you the skeleton of the pitch deck that I require from the projects that apply to me. Make sure that try not to let the total number of slides exceed 20. Before you start preparation (creating a presentation), take a look at the chart that shows how many seconds on average the recipients spend on a given part of the presentation, so that you will know what is worth emphasizing.

LOGO and MISSION. In the form of punchline/tagline (example: NIKE – just do it!). It is one sentence that defines what the company does.

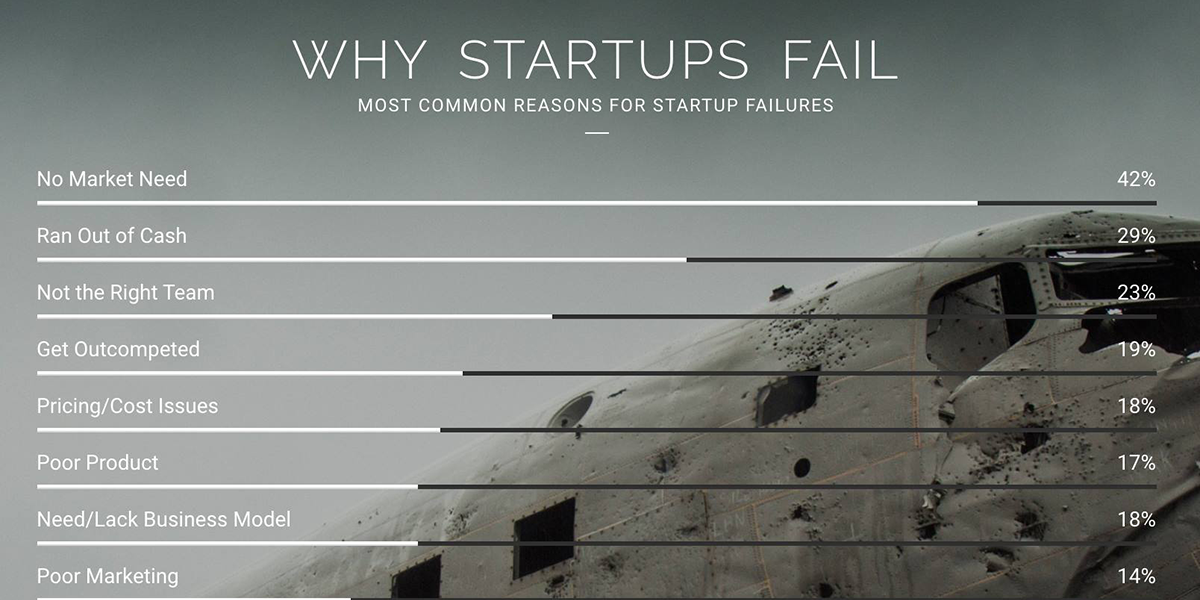

LOGO and MISSION. In the form of punchline/tagline (example: NIKE – just do it!). It is one sentence that defines what the company does.- PROBLEM. Where did the idea for the product come from? What need does it fulfil? How do you know that people need it? The investor wants to be sure that your business addresses a real problem and in result will improve the quality of life.

- SOLUTION. Present your idea in a simple way of how your company solves the problem described above and also show the benefits of your solution. What is the uniqueness and innovativeness of your product? What makes you unique (stand out)? Why do you think that customers will choose your product? What is your distinguishing feature?

- PRODUCT. Show how your product looks and how it works in simple steps. Don’t go too deep into details. It is important that the content is as simple as possible. Investors will ask about your product anyway. It is worth showing here off photos, diagrams etc.

- THE HISTORY OF COMPANY. Since when is your solution available on the market? How many people use it so far? How many clients do you have? Show me your sales data on a monthly basis for the last 12 months in a table. How many contracts with clients have you signed? How many letters of intent have you sighed? How many people have signed up for your newsletter or to your email database? How much money has been invested in the company so far?

- THE MARKET. Who is your target customer? Try to determine how many people are affected by the problem and how many of them will be will use your solution in the future. Be sure to provide numbers, eg. the value of the market in Poland and in the world, the number of customers, the frequency of using your service etc. This section is to show the potential of the next stages of the company’s development.

- THE TEAM. This is a very important element of the presentation, which is to convince investors that it is worth carrying out this project with you. Show us who is responsible for each part and what experience they have so far. Provide only the information that is the most relevant to the company. Adding your photos will put a human face on the information.

- BUSINESS MODEL. This is an important element to show how your company earns money – specifically and in numbers. How much will your product cost? Will the service be paid on as a one-off payment or as a monthly subscription? What are your projected costs and revenues in the coming years of your company’s development? Who will pay for the product? Customers? Advertisers? Provide a monthly table of projected revenues and costs for the next 12 months after receiving your investment.

- FINANCIAL EXPECTATIONS. Present the amount of investment you need to collect, detailing what the funds will be allocated for. You can refer to the next stages of the company’s development. It is important that you give the investor confidence that his money will be properly managed. How many months after investment does the company plan to reach the point where the revenues will exceed the costs? Determine if and when you will need mode funding and how do you plan to obtain it?

- COMPETITION. It is worth conducting market analysis so that you will be able to eliminate most of the potential threats. How is your product better than the competitions’? Why will customers use your product instead of the product of your competitors? What do you know that others don’t know? What makes you different (what is your distinguishing feature?)? What are the key issues in your industry that others don’t understand? What is your advantage?

Send your pitch deck to email: lukas@zgiep.com where I will be happy to read them and then I will contact you to arrange the details of cooperation.

Cheers,

LSZ