The stories of companies like Amber Gold or GetBack bring up issues related to investments, frauds and investor’s safety. With every other similar case, the awareness of society rises. The investment product that “guarantees 12% (and even more) of profit per year” simply does not exist. I am glad that the knowledge, experience and awareness of people investing in certain projects grow every year.

In several years ZUS (Social Insurance Institution) will become insolvent, so it is worth thinking about our own private retirement. By the way, I’m curious if you know what ZUS invests your money in?

There are many ways of investing, I don’t want to focus on this topic today, so if you are interested I invite you to my newsletter. I’d like to emphasize one fundamental rule:

In XXI century everyone is an investor!

It is worth investing in everything that will bring added value to society in the future and what would be the best value for us and for our surroundings. For example, I would not invest in coal mines, which production process is connected with environmental degradation, illnesses and accidents among miners. Moreover, carbon consumption affects air pollution and entire ecosystems. I would like to invest in producers of solar panels which are the future of energy technology/energetics.

To invest in a company, you can for example become an owner of its stocks or shares. Until recently those kinds of operations were only possible in public trust institutions, eg. in brokerage houses. My trust in this type of places is regularly declining, not only because of GetBack procedures but also due to high fees, complicated investment process and a lack of understanding of an innovative partner. Trust is essential in investments. However, such a thing as a solid/sound investment does not exist. Each investment involves a certain risk and it is up to you, as an investor, what level of risk you are willing to accept.

Before the appearance of blockchain technology, financial institutions had the exclusive right to shares and bonds emission, because they were the guarantor of transaction security. Ensuring safety for every transaction party and building investor’s trust generates costs, covered by the investor himself. Stocks, bonds, ETFs and any other securities in the new economy are guaranteed by mathematical algorithms and smart contacts. Once smart contact is launched, it can’t be withdrawn, so blockchain technology reduces costs significantly and guarantees the highest possible security level when trading this type of instruments. It eliminates the need of generating trust in the institution. I estimate that up to 5 years most financial institutions dealing with emission, distribution and trading of financial assets will use blockchain technology.

The United States Securities and Exchange Commission (SEC) has recently regulated trading financial assets that use blockchain-based tokens.

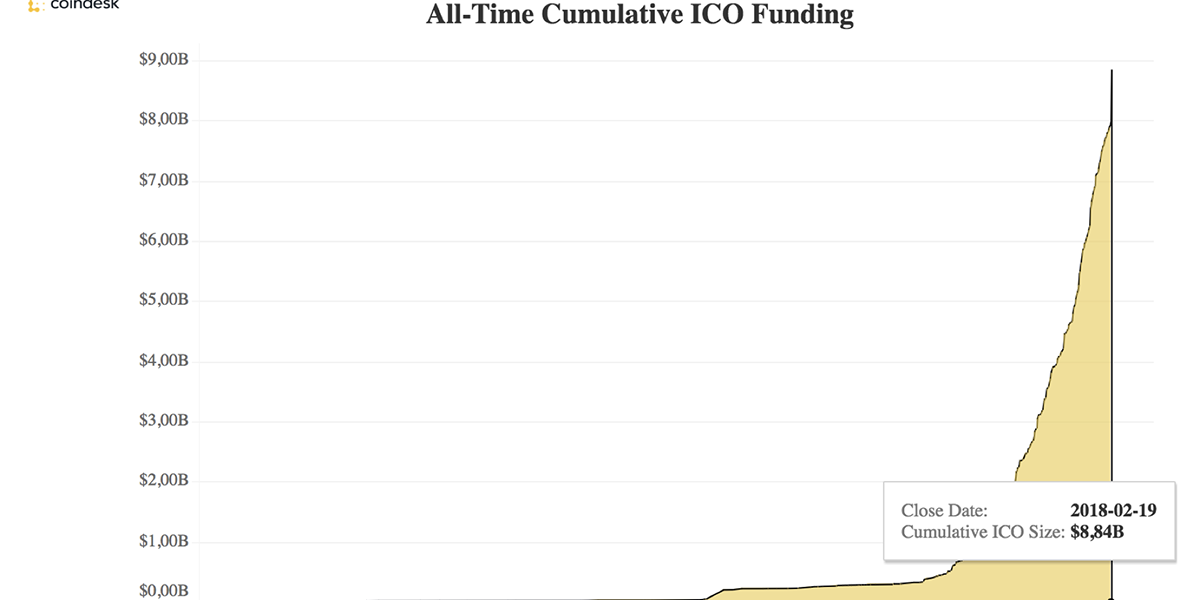

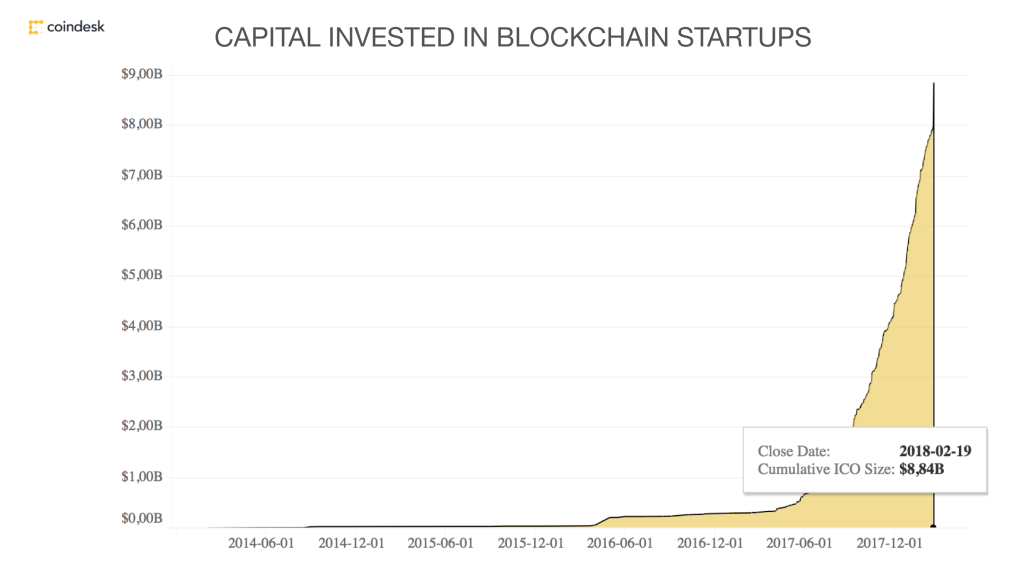

Initial Public Offering (IPO) and his token counterpart Initial Coin Offering (ICO) are currently regulated in over 20 key markets, including the USA, UK, Australia, Germany, Singapore, Switzerland, Estonia, Gibraltar, Malta, etc. The main reason for those regulations is the exponentially growing amount of capital invested by investors around the world in assets based on blockchain technology and also the level of disruption in business processes caused by this technology.

ICO is an innovative way of gaining finances from investors to implement the project. The token that is only stock or share in the company that issues it, is called Security Token.

If, on the other hand, during ICO, investors gain tokens that in future will be necessary to use a given product or services, then those tokens qualify for the Utility Token category.

There are also countries that have not yet started regulating those investments (including Poland), as well as those that are trying to ban such transactions (eg. Korea or China).

A huge advantage of financial assets based on blockchain technology is their safety and the elimination of the fraud risk of a broker – that means if you are the owner of a given token (which is equivalent to having the rights to the financial asset), you are its sole owner. It is technologically impossible for the collapse of the brokerage house, bank or another broker to cause your loss.

A new concept of Security Token Offering (STO) is being formed. STO aims to combine the advantages of ICO (including low costs, security, transparency, transaction speed) and IPO (the present legal system) by legitimizing the issue, distribution and token trading. Currently, the ICO procedure is unregulated in many markets or the same rules as in the case of IPO apply. Combining together the advantages of ICO and IPO can bring huge benefits for investors and also in the development of innovation on a global scale. It is worth emphasizing that STO can be secured with real capital, eg. real estates or profits.

The sooner we can achieve global consensus and transfer certain financial assets to much bigger blockchain technology, the more liquid they will become and it will be easier to manage our investment portfolio and diversify its composition.

Cheers,

LSZ