Introduction

Equity crowdfunding is a phenomenon that has been exceptionally dynamically developing on all continents since the 10’s of the 21st century. Equity crowdfunding platforms from around the world allow you to make investments in companies that are looking for capital for development in just a few minutes. By 2020, millions of investors from all over the world have invested billions of dollars in tens of thousands of companies. Interestingly, capital for development is obtained in this way not only by startups or high-tech companies, but also by companies from more traditional industries. The campaigns were successfully completed by numerous: breweries, restaurants, manufacturers of video games, B2B companies, IT companies, manufacturers of consumer goods and services and even sports clubs. Increasingly popular among investors has also been real estate crowdfunding.

ECF market in the EU

According to the data presented by The Cambridge Center for Alternative Finance in the 5th UK Alternative Finance Industry Report, the ECF market (equity crowdfunding) in Europe is developing dynamically. The UK is currently the industry leader. I present the specificity of the European ECF through a short description of crowdfunding platforms in the largest countries. At the very beginning, it is worth returning to the data from the report mentioned above and emphasizing that the share of Great Britain alone is USD 416 million. Moreover, the British ECF has almost exceeded twice the value of the local Real Estate Crowdfunding.

Seedrs was the first crowdfunding platform to receive approval from the British regulator (Financial Conduct Authority) to operate. Their mission is to enable every investor to invest in a business they believe in and with which they want to share their successes, and also to enable any growth-oriented business to increase capital and community. Projects on Seedrs cover very different areas, from infrastructure development – Hyper Poland, through healthy eating – Manilife, to promoting good saving and investing habits – Smarterly. Over 967 campaigns were run on Seedrs.

The second recognizable crowdfunding platform in the UK is Crowdcube. Their start was a bit different than Seeders’. Crowdcube received approval to operate two years after the company was founded. Seeders in turn had a license even before working on the first projects. Crowdcube supports startups from various industries. Among the completed campaigns, the largest and most recognizable companies handle finance – such as Monzo or Revolut. Crowdcube has run over 1,000 ECF campaigns.

The leader of the German market is Companisto. The crowdfunding platform was founded in June 2012, and during the first 12 months, conducted 18 campaigns. In addition to allowing investment in shares, Companisto also offers two other methods of investing – Equity Shares and Shares Angel. Membership in the club of angels brings many benefits and creates an opportunity to co-finance enterprises on preferential terms, but it requires much more commitment, the minimum investment amount is 10,000 EUR.

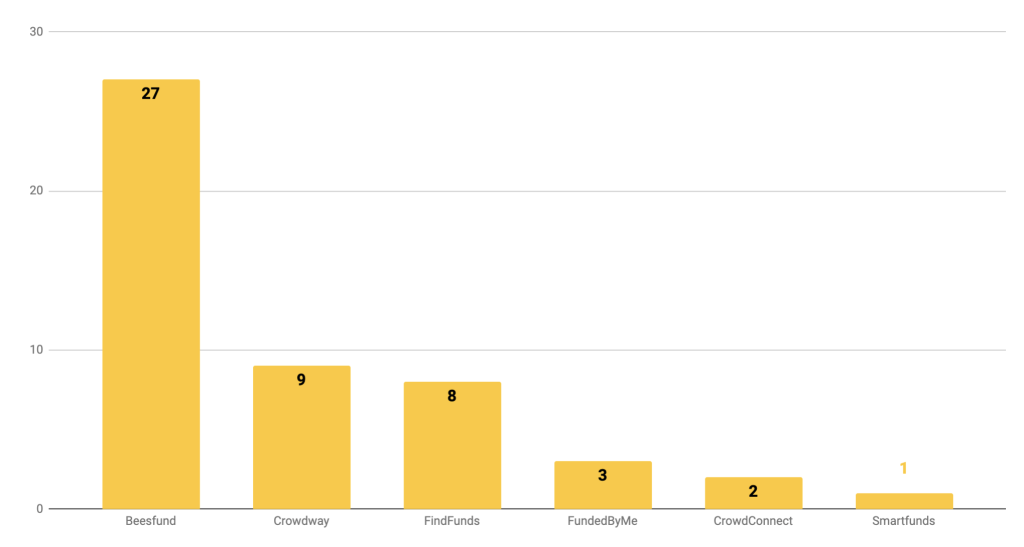

The largest ECF platform in Poland is Beesfund.com. More than 73 campaigns were carried out, in which over 44,000 investors invested a total of over 43 million PLN. The platform was created in 2012, but its dynamic development started in 2018 after the introduction of new regulations that allow each joint stock company in Poland to obtain 4 million PLN once every 12 months through the ECF.

WiSEED is a platform from France. It is one of the largest and at the same time the oldest institution of this type. The platform was founded in 2008 and since then it has financed over 507 projects, with a total value of 209 million EUR. The website has detailed and very interesting statistics, among which we can find the tab with the assessments of completed projects, issued by the users WiSEED. So far, 194 projects have been assessed, as many as 184 have obtained a positive result, which proves their high effectiveness.

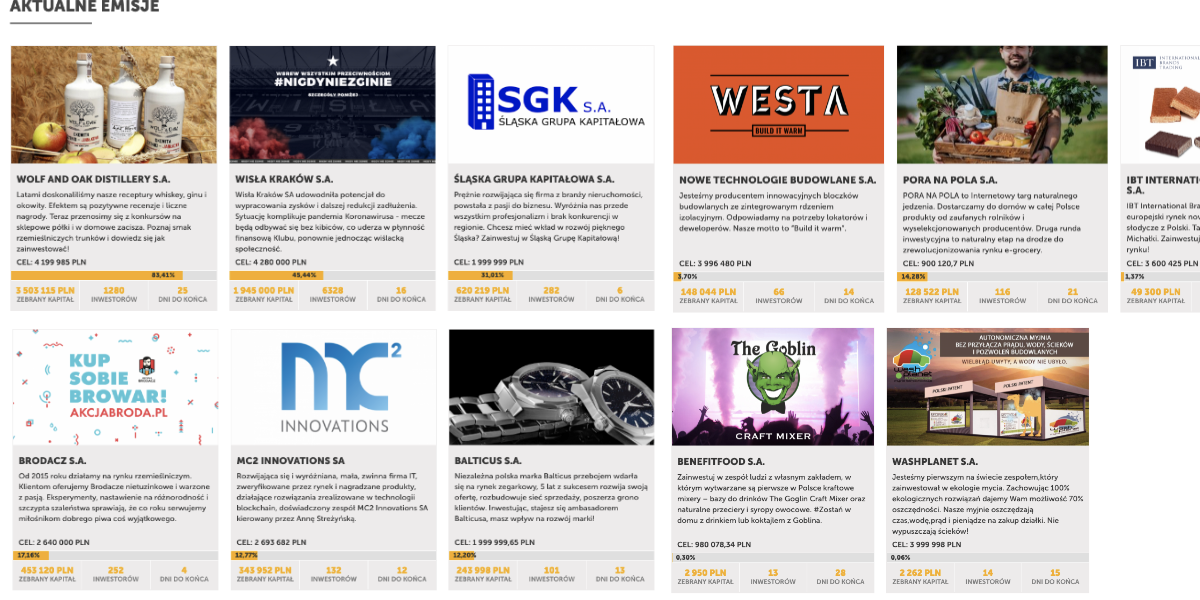

ECF market in Poland

The Polish crowdfunding market is definitely younger and smaller than the Western European ones, but it is developing dynamically and has enormous potential. In Poland not many people have heard about equity crowdfunding, the number of investors is tens of thousands of people, financing in this way was obtained by approximately 100 companies in the amount of several million PLN. 2019 was a turning point for the Polish ECF for several reasons. First of all, for the first time on the Polish market, startups that started to raise capital through crowdfunding platforms debuted on the Warsaw Stock Exchange. In addition, in 2019 alone, 50 companies used this method of financing, obtaining a total of 52 million PLN. But that’s not all, because for the first time investors had the opportunity to realize profits by selling their shares to strategic partners of companies or through the Warsaw Stock Exchange.

Number of ECF campaigns conducted by Polish platforms in 2019:

Market in the US

In the United States, the so-called alternative financing market, part of which is equity crowdfunding, is growing rapidly. In 2015-2017, the growth rate was approximately 25%. In 2017, its value of the ECF market amounted to 253 million USD, for comparison, the value of Real Estate Crowdfunding in the same year was 1 861 million USD. An example of the American ECF platform is CircleUp. Functioning of this platform is very similar to the Companisto – there are two methods of investing, directly or by purchasing a shareholding. Regardless of the method of investing the funds, the minimum investment value is 1,000 USD.

Benefits for companies

Both using the ECF and entering the WSE brings similar profits to the company, but there are also a few differences. The ECF campaign is usually chosen by smaller companies that are at an earlier stage of development. A debut on the WSE or on the NC market can be the next step after the ECF campaign.

1.Funds for the development of the company – it is obvious, every company needs fuel, which is money, to develop faster.

2.Building a community around the company. If several hundred or several thousand investors invest in the company, this huge community causes magical things to happen, which often exceed human imagination.

- Products and services marketing. The ECF campaign is a great opportunity for marketing company’s products and services and offering a partner program for shareholders, clients, etc.

- Introducing a new product to the market and reaching new customers. Most ECF campaigns attract the attention of not only investors but also the media. This can be a great opportunity to communicate the company’s introduction of a new product or service.

5.Help. It happens that some companies with traditions and a recognizable brand get into financial trouble. An ECF campaign can be a good way for the community to regain power over a recognizable brand and steer it on the right track.

6.Increase in sales. The vast majority of companies I have worked with emphasize that the sale of products or services increased significantly during the campaign. Often these are increases at the level of 100% – 300%.

7.Preparation for the next round. Conducting an ECF campaign can be a good method of preparing for negotiations with subsequent investors at further stages of the company’s development. The success achieved during the ECF campaign increases the negotiating advantage in the following rounds.

8.Shareholder relations and contacts. This is often not seen in public, but company managers emphasize this value in the long run as one of the greatest strengths of the ECF. Access to hundreds and sometimes thousands of shareholders is a powerful relational, networking and, if necessary, investment tool.

Benefits for Investors

For the vast majority of investors, the most important thing is return on investment – it is obvious that they risk their funds waiting for an above-average return on investment. Investing in an ECF creates space for investments that are not available anywhere else.

The main benefits for ECF investors:

- Possibility of investing in innovative companies, startups with development potential.

- A chance for above-average rates of return.

- Diversification of risk in the investment portfolio.

- Direct impact on building your investment portfolio.

- Possibility to support the company and participate in the general meeting.

- Additional benefit packages are often available only to the company’s shareholders.

Risks and exits from investments in ECF

Every form of investment carries risks, and the ECF is no exception. Investing in startups and companies at an early stage of development involves high risk. The earlier stage of a company’s development is, the greater risk it becomes for the investor. It is worth mentioning the main risks, including the risk of a lack of liquidity, no dividends, loss of some or all of the invested funds and the risk of dilution in subsequent rounds. These types of investments should only be made as part of a diversified portfolio. Investments in ECFs should only be of interest to investors who have sufficient knowledge to understand these risks and make their own investment decisions. The rates of return on investments in companies at an early stage of development may also be proportional to the level of risk. For example, ECF investors in Revolut achieved a return on investment of 1900% in 2018 in two years after the campaign. A list of other investment exits can be found, for example, on the Crowdcube platform.

The future of the ECF

In such a dynamically growing market, it is difficult to indicate precise directions of development. Taking into account the pace of development of the ECF around the world, it seems that this form of investing and raising capital by companies in the beginning of the XXI century will be gaining in popularity. Tangible benefits for companies resulting from the EFC campaigns and advantages for investors who are willing to invest some of their portfolios in risky investments have a great importance. I watch the stories of companies that build their competitive advantage thanks to the ECF campaign.

Moreover, new regulations are currently being prepared in Europe. They will have a significant impact on the shape and pace of EFC development in the EU member states. In the coming years, those regulations should be introduced in all countries, resulting in one common ECF market being created, accessible to all companies and investors from the EU. One single market for over 512 million people. If you are interested in the subject of ECF, please subscribe to my newsletter. I send the newsletter with only the most essential information.

Cheers,

LSZ