In the past, the ways of raising finances needed for development by companies were quite limited. If their founders didn’t have their own financial resources or rich uncle, they would have needed to convince investors. Those people in turn did not always understand innovative ideas or they demanded full control over the whole project. In the era of the Internet authors of original concepts can skip through single investors and refer to potential buyers or smaller investors instead.

What does the traditional startup financing model look like?

In a traditional model of gaining finances for a new business, the first obstacle to overcome (of course after creating a business plan!) is convincing family and friends to support our idea. Most investors believe that if a beginner entrepreneur is not able to convince his/her closest people that it is worth entrusting him with funds for the development of the company, it is not worth either for him to lose his time getting acquainted with his idea. It’s hard to deny a certain logic here.

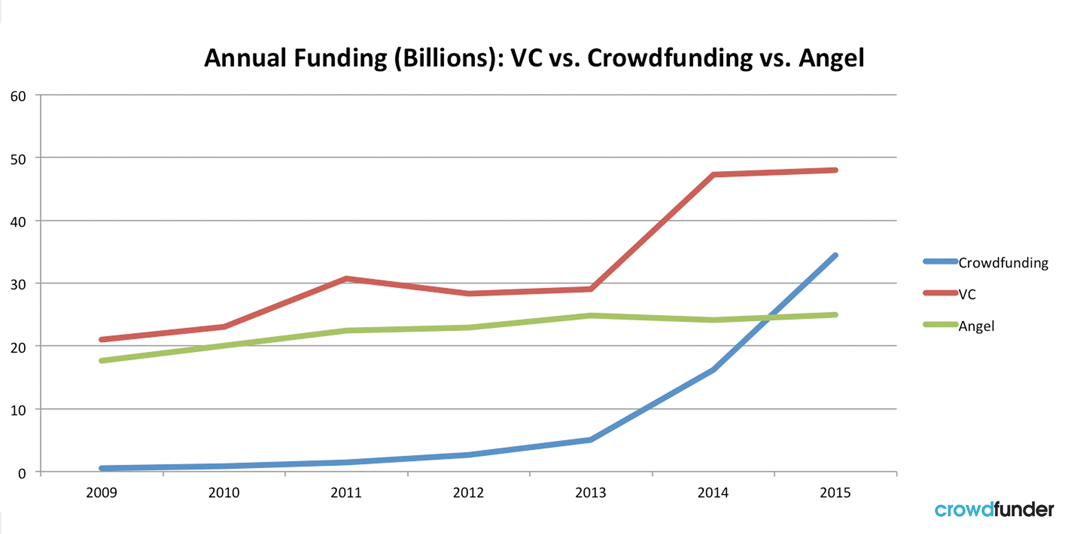

Only then do the first rounds of financing begin. The business angel decides to entrust their money to companies in the start-up phase, hoping on receiving/getting a big refund, which is also equally highly risky. Later, if the company will bring the first profit or show huge dormant potential, the Venture Capitalists step in. They manage big entrusted funds and they willingly invest huge amounts of money in promising startups, expecting full control over it in return.

Along with the dissemination of crowdfunding, the old financing model is being replaced with a new one. The funds needed to develop business aren’t only in hands of a very narrow group of millionaires – nowadays everybody can invest in it.

Collaborative economy – a new model of business activity

Lately, the collaborative economy gains more and more popularity. Probably everybody heard of enterprises that function in that way, eg. Uber, BlaBlaCar, NextBike or Airbnb. If we add up those more and less known companies, the total number in the world has crossed over 10 000.

This model changes the ways of how traditional businesses work. The companies that deal with passenger transport don’t have their own cars; the companies renting apartments don’t have their own apartments.

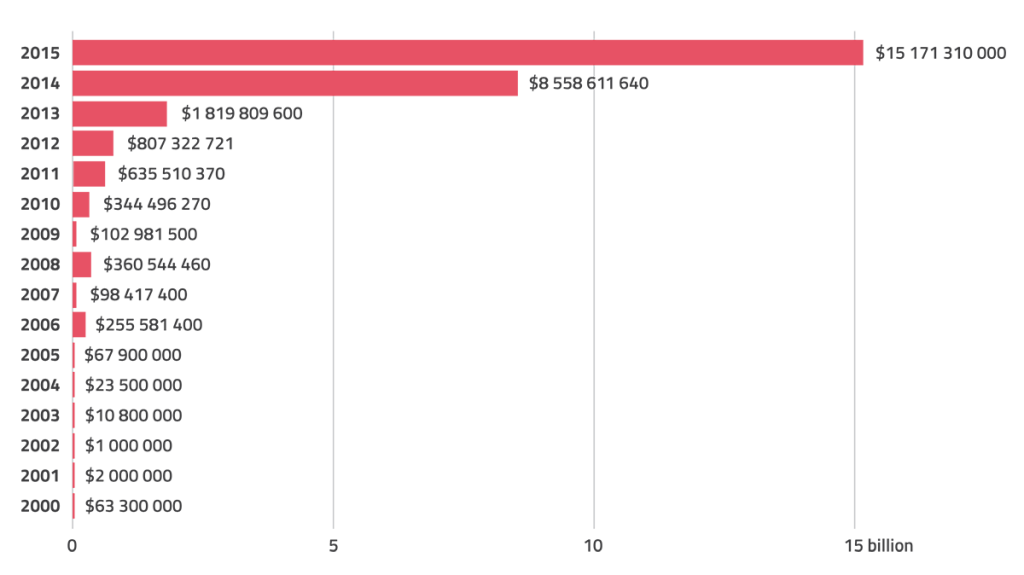

The success of the collaborative economy can be described in a good way by investing in startups that decided to operate in this business model. For the few years, the number of resources gained in this way started to grow rapidly and recently outgrew over five times the amount of money allocated for social media.

It is needed to keep in mind that crowdfunding is just a small reality slice in the world of the collaborative economy.

What is crowdfunding and how quickly it is gaining popularity?

Crowdfunding is a method of gaining resources by entrepreneurs and artists. It makes them able to skip through traditional investors so that they can raise money directly from consumers or smaller investors.

This method gains popularity due to its flexibility and owing to it, the previously undeveloped parts of the market are being filled.

What models of crowdfunding currently exist?

The first and the most popular crowdfunding model is reward crowdfunding. In Poland, the most popular platform is PolakPotrafi.pl. People who supported a certain project will get the final product discounted. If the amount of entrusted money is bigger, they can count on getting additional exclusive prices. For example, it can be a product signed by authors, t-shirts with the company logo, the possibility of talking with founders, special thanks in credits. The main motive of supporters of a certain project is the will of it to go public (is the will to come out one day).

Lending crowdfunding is when an entrepreneur borrows money on his project from others and then pays it off. The system is similar to a bank loan, but instead of one subject, the lenders is a group of people that decided to lend money to the entrepreneur.

Equity crowdfunding makes people invest in certain project capital returns dependent on the profit of a project. If it’s a failure, they take a loss. If it becomes a success, they will receive a return on investment proportional to the level of success. The biggest equity crowdfunding platform is Beesfund.

It is important to emphasize that there is practically no area of life that has not yet had a crowdfunding campaign on its account. Crowdfunding exists due to the passion of the community, which is why projects aimed at a niche audience are often extremely successful. This is one of the main reasons why the new form of gaining funds is sure to change the world for the better.

The benefits of using crowdfunding (for startups and shareholders)

In 2016 the amount of money gained for startups thanks to crowdfunding exceeded the funds allocated for this purpose by Business Angels and Venture Capitalists. This is a clear change of game rules that apply to novice businessmen.

The benefits for a startup in this model are quite clear. The startup gains the funds needed to implement his idea, bypassing traditional investors. It gains a group of devoted fans ready to support the project and recommend the company to friends. Some of them may have useful business relationships that the company can use.

The benefits for a startup in this model are quite clear. The startup gains the funds needed to implement his idea, bypassing traditional investors. It gains a group of devoted fans ready to support the project and recommend the company to friends. Some of them may have useful business relationships that the company can use.

Every entrepreneur who decides to raise money using the fundraising method conducts a test of the attractiveness of his idea. There is a good chance that after a successful campaign he will also find a traditional investor, which happens to 74% of companies. If a campaign becomes a failure and a businessman hasn’t made mistakes in running it, it probably means that the concept itself is wrong and perhaps the entrepreneur had missed out on the monstrous/terrible experience of launching a product for which there is no demand.

Investors, in turn, get the opportunity to invest in a startup without having the huge amounts of money that Business Angels have.

Why is it worth allocating some of your funds to investments in the equity crowdfunding model?

Equity crowdfunding is in fact a risky method of investment, but it also offers the possibility of gaining/achieving a huge refund on capital allocated to it. It is often even 25% per year, but also it depends on the individual specifications of a given company and the environment in which it operates.

The advantage is the fact that experienced in certain industries people can use their knowledge to evaluate the prospects of a newly emerging company. For example, if someone knows a lot about renewable energy, he also has a better chance of predicting whether the new product has a chance of success or not.

Crowdfunding is good for society (has a good influence on society)

Crowdfunding allows many beginning entrepreneurs and artists to try their hand at projects that would not be approved by traditional investors or producers. As a result, more and more unique products intended for a niche audience appear on the market and the needs of a growing group of people are satisfied.

Many crowdfunded projects help people with everyday life. A good example can be the Polish application DrBarbara, which supports people trying to maintain a diet and helps users to learn eating healthy.

Raising money means the possibility of choosing which product should enter the market and which should not, goes to the hands of Internet users and as a result, they often decide to support pro-social initiatives.

It is worth mentioning crowdfunding as a tool used for charity purposes. A good example here is the GoFundMe platform.

As you can clearly see, crowdfunding is beneficial for a very wide group/variety of people and over time it will lead to a profound transformation of the way that the economy and society function/work. A paradigm shift will improve the quality of life for all of us.

Cheers,

LSZ