Blockchain technology is increasingly making its way into the mainstream. I would be tempted to say that it will be the most fashionable word of the year, I officially announce 2018 as the year of blockchain in Poland. Corporations, startups, investors, regulator and universities are increasingly interested in solutions based on blockchain technology. Many people come to me with questions about how to choose a project for investment, what should you pay attention to in order to eliminate the investment risk? Which investments to avoid and how to verify projects? How to choose a good blockchain project for investment? I always emphasize that investment risk cannot be 100% eliminated, and as an investor we can only minimize and diversify it.

ICO – Initial Coin Offering

Blockchain projects have several additional factors to consider. It is primarily the distribution and allocation of the collected funds. If, as an investor, you see that the division, distribution or issue does not look fair, that is reason enough to give up such a project. If you do not know if there is an ICO and how it works, please click here.

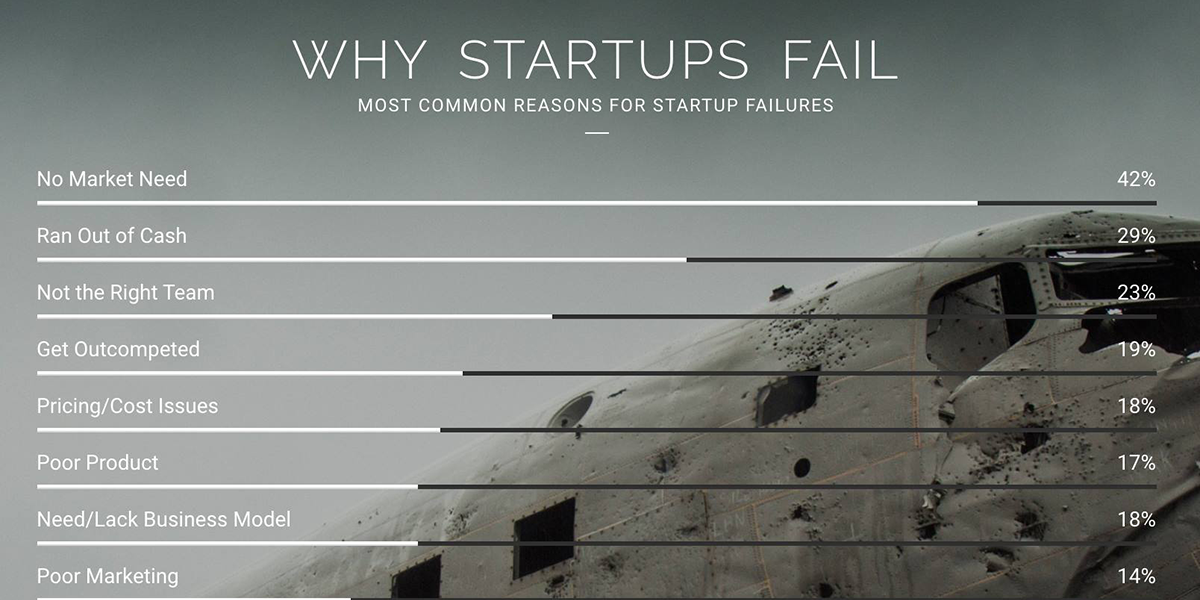

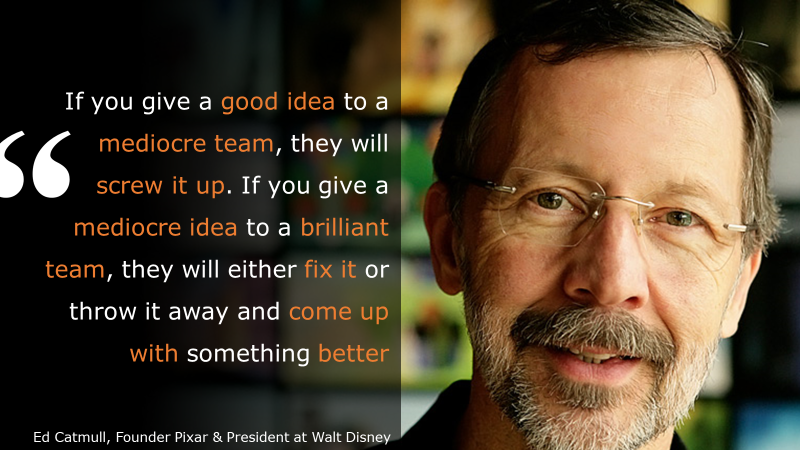

Team

When analyzing the project, first of all, it is worth paying attention to the team behind the project, because at the end of the day, after collecting funds from the investors, they will be responsible for its implementation. Here is a little curiosity, imagine my surprise when at the end of last year it turned out that one of the ICO projects set up a second profile for me on Linkedin to pretend that I am one of the team members. Fortunately, after reporting, LinkedIn quickly resolved the situation and deleted the fake account, but you have to remember that scammers go so far as to act brazenly.

Technology

The second most important issue is the technological solution that is or is to be used in the future. This is how the project plans to add value with its solution. Blockchain projects are often characterized by complex technological documentation. More than once I have dealt with white papers with over 300 pages of technological description. For the average person unfamiliar with technology, it may take a tremendous amount of time to study such a document with understanding. It also happens that ICO projects promise to find a solution to a technical problem only after several years of operation. The risk related to the technological aspect is therefore relatively high. I remember when I analyzed blockchain technology for the first time, it took me about 2 weeks of research to fully understand the mechanisms of this technology. I think this is an effective entry barrier for new investors.

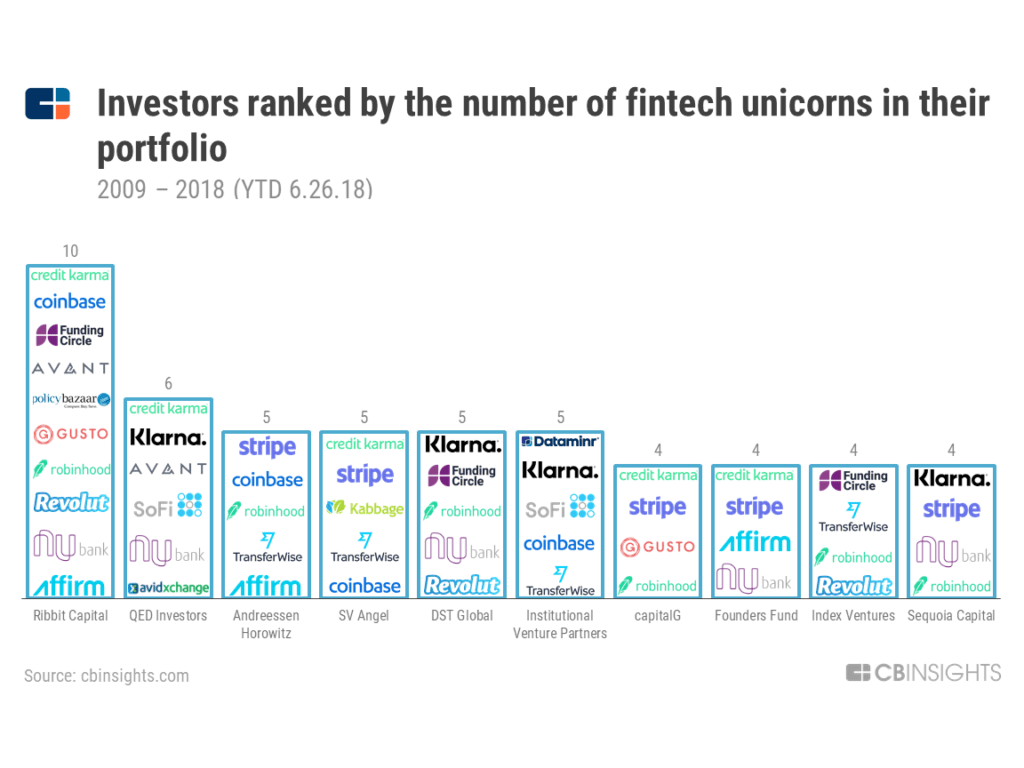

Existing investors, such as Business Angels or Venture Capital

It is worth checking if anyone before us has already invested in the project and what are their experiences with the team. Finding a prospective project in the seed stage is extremely risky. Therefore, most investors do not want to be the former. Some investors prefer even conditional investments in the so-called co-investment. Investing in a project that others have already invested in is definitely less risky and increases the likelihood of success of a given company.

Quotation

This is a very difficult issue, especially at the beginning of any project. There is some regularity that the fresher the project is, the more difficult it is to price it, as there are many unknowns. As each company develops, subsequent issues are clarified (e.g. the company delivers its technology and acquires the first customers). It is worth paying attention to the basis on which the company made the valuation and whether their solution is not priced too high.

Scams

After a detailed analysis, we increase the probability of finding a valuable project. However, we can never 100% eliminate all risks. Keep in mind that scammers find their way everywhere, I recommend that you follow the ICO scam lists:

deadcoins.com

coinscamlist.com

Summary – those who don’t risk don’t drink champagne

It is worth following the development of new technologies because they create added value in our lives. The earlier we invest in an innovative project, the higher our return on investment will be. It is difficult to keep abreast of all trends in economics and technology. I even put forward the thesis that in such a dynamically developing world it is almost impossible. Perhaps that is why people who can identify leading technologies early are able to achieve above-average returns on investment. In my opinion, it is worth starting investing in risky projects with small amounts. Those whose losses we will not regret. Thanks to this, we will take the first steps and gain very valuable knowledge for the future.

Cheers,

LSZ