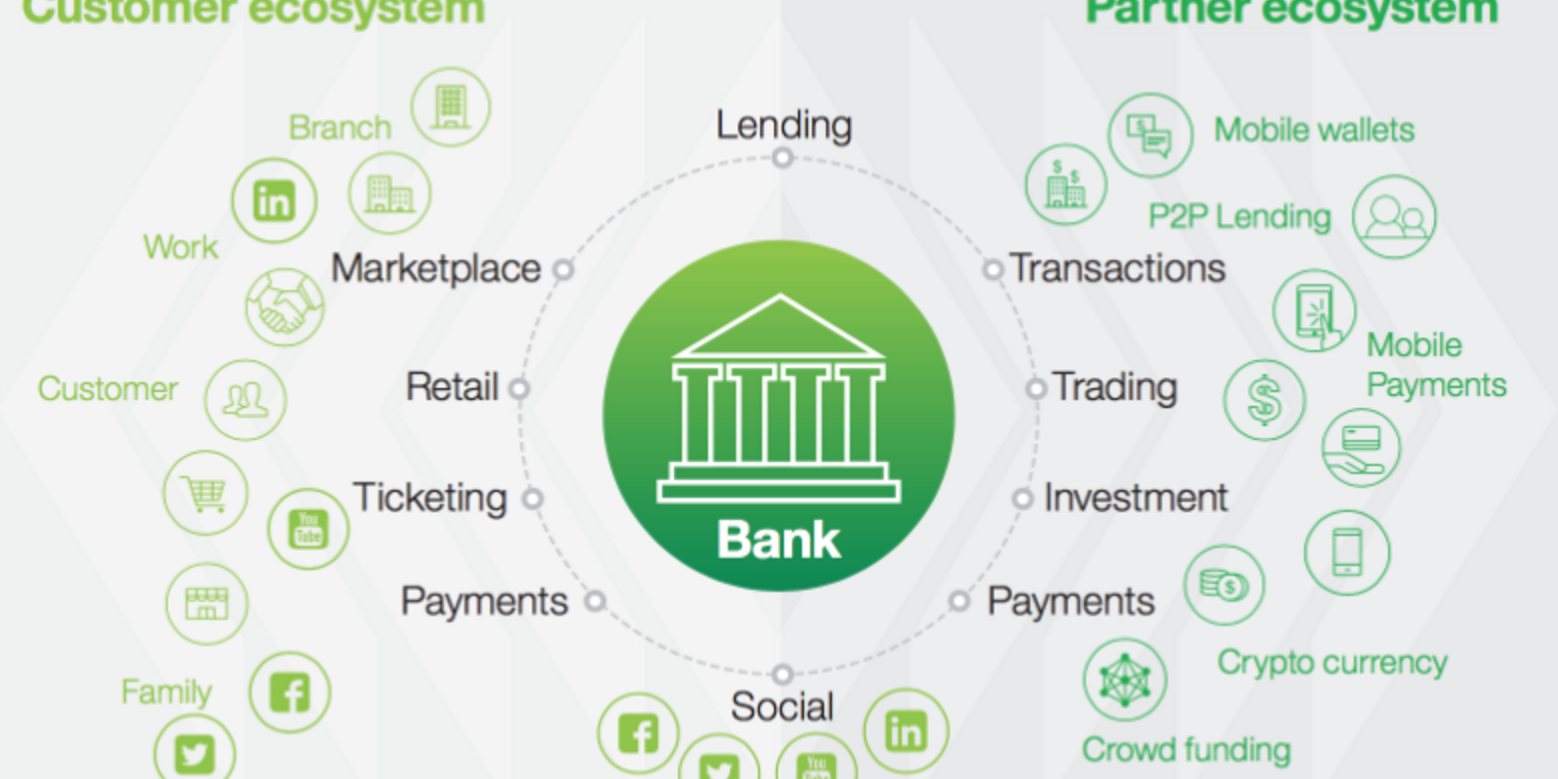

From the very beginning, the financial industry was obscured by a wall of legal regulations to ensure liquidity and, above all, security. The foundation of every bank is credibility, trust and security. Bank customers must be sure that their funds are safe and that the bank is solvent. In the age of the internet, both liquidity and security can be provided by technology. Thanks to computerization, the efficiency and effectiveness of banking processes has improved, while reducing costs. We have come to a point in development when people, thanks to technology, can provide financial services to each other without the involvement of banks. Social loans (P2P money lending) revolutionize the deposit and loan market both on global markets and in Poland. The bank in the form of an intermediary becomes an unnecessary link in the entire chain of the deposit-loan process. Thanks to technology platforms operating in the collaborative economy model, people can share their goods with each other (in this case, money). The costs of such transactions are marginal because it comes down to easy-to-use verification systems and cashless transactions. In the coming years, we will witness changes that will take place in individual and corporate banking. There are already websites that allow for B2B loans. The level of disruptions brought about by new technologies in the financial services sector has a very high growth potential. An additional advantage of companies operating in the EW model is trust, which, thanks to full transparency and quick and effective verification, ensures that loan repayment remains at the same level as in the case of traditional financial institutions. In some cases, this ratio is even higher than that of banks, possibly due to better verification and the communities that form these sites in general. There is a high probability that newly created social loan websites have a lot of space to improve their customer verification systems (banks have been building their methods for centuries), thanks to which loan repayment will increase. If this happens, collaborative economy services will be more competitive compared to traditional banks.

The second element of the collaborative economy, which is developing very dynamically, is crowdfunding. This area of the collaborative economy is particularly popular in Poland – over the last few years, more than 10 crowdfunding platforms have been created, which remain on the market and are dynamically developing. The method of financing investment projects is changing significantly, and crowdfunding is becoming a real alternative to bank loans and EU subsidies. A proof of concept is a huge added value and a competitive advantage over traditional forms of financing projects. When planning to set up a company that produces electric skateboards, you can build a skateboard prototype from your own funds. Then, prepare a campaign on the crowdfunding website targeted at people who are in our target group. The next step is to record a promotional film, prepare prizes for people who will pay money to launch mass production – for example, PLN 200,000. If we manage to collect a given amount, we can start the production of a new product already having a customer base who trusted us by paying money, e.g. we sold 100 skateboards for PLN 2,000. For years, revolutionary products have been created in such a model around the world, for example, the originators of the Pebble watch collected over USD 20 million for its production in 2015, while selling it in the so-called before producing 80,000 units.

The financial industry is currently facing one more new technology that will significantly affect its functioning. Simultaneously and regardless of the economy of cooperation, at the turn of the 00s and 10s of the 21st century, blockchain technology was created, which is gaining popularity. Thanks to blockchain technology, it is possible to send all kinds of data in digital format, e.g. money, documents, files, etc. The most popular currencies based on blockchain technology are currently Bitcoin and Ethereum. Digital currencies that enable real-time global funds transfer at virtually zero cost. Transactions involving Bitcoin or Ethereum cannot be falsified or withdrawn, they are carried out in real time and automatically confirmed by other users of the technology in a split second.

Everything indicates that only the most innovative entities that adopt a strategy for implementing modern fintech solutions have a chance to remain on the market. The market will quickly verify banks’ strategies – in the next few years we will see which institutions have taken the right direction. One thing is for certain banks that will not follow the times and technologies will disappear from the face of the earth.

Please see the mini poll in the comments section at the bottom of this page:

Which banks in Poland are, in your opinion, the most innovative, and which are fossilized and “traditional”?

Enter your favorite banks in the comments.

Cheers,

LSZ