Collaborative economy business models know no boundaries, especially in the financial industry and its technological branch – fintech. In addition to the increasingly popular services such as crowdfunding, equity crowdfunding, social currency exchange and cryptocurrencies (Bitcoin), P2P money lending, i.e. social loans, is dynamically developing. Social lending, otherwise known as peer-to-peer lending, is developing very dynamically in countries where regulations favor innovative financial services. Unfortunately, Poland is not one of them yet. It is a pity, because in less than 3 years the global social loan market has grown tenfold from USD 600 million in 2012 to USD 6 billion at the end of 2015. According to PwC, by 2025 this market may grow to at least USD 150 billion.

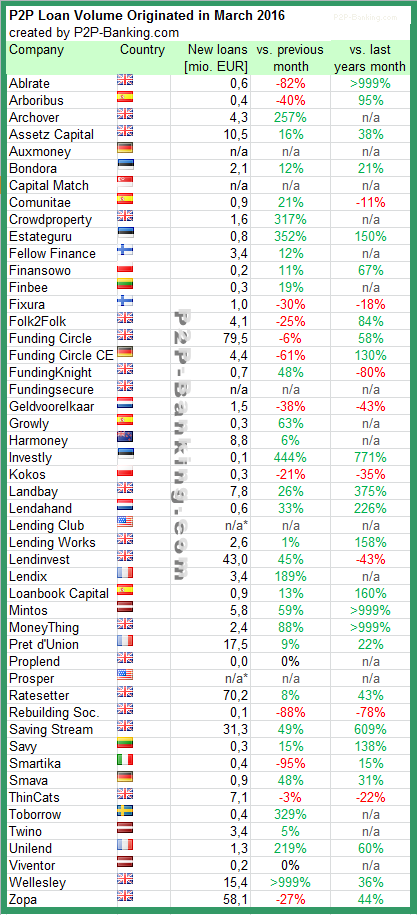

Here is the list of the volume of social loans granted in March 2016, compiled by the portal www.P2P-Banking.com:

www.p2p-banking.com/countries/germany-international-p2p-lending-statistics-march-2016

There are two Polish websites: www.finansowo.pl and www.kokos.pl. Unfortunately, they have no right to exist in Poland. At the moment, the anti-usury act and the ruling of the Supreme Administrative Court of 2012 are effectively blocking the development of social lending in our country. This is a very unpleasant situation, because it contributes to the outflow of investors abroad, reduces the development of entrepreneurship in the country and forces over 1.5 million Poles to use payday loans. P2P money lending can more honestly fill the gap visible in the loan market in Poland.

As Artur Nowak Gocławski, the founder of the ANG credit advisers’ cooperative and the online mutual loan platform, believes:

“However, horrendous fees to financial institutions can be avoided. By borrowing money from each other, without financial intermediaries, online. Just as Uber has revolutionized urban transport, and Airbnb – hotel services, the American portal Lending Club, or its biggest competitor Prosper – revolutionize the market of short-term financial loans (“Peer-to-peer lending”). By associating ordinary people who have money with those who need financing. This year, the revenues of the Lending Club, which has been listed on the New York Stock Exchange for a year, are expected to grow 72 percent to over a billion dollars. “

The problems of Polish social ledning began in 2012 due to the ruling of the Supreme Administrative Court in which it agreed with the tax office in Gdańsk that the income obtained from the social loan is income from economic activity, and not from financial activity, as it might seem. Moreover, in order for a natural person to be able to borrow money to any other natural person via a P2P platform, they should set up a company – the NSA decided that social loans are non-agricultural business activities (!?!). In direct interpretation, this means that currently in Poland, people who want to lend their money to other people via the Internet must meet the requirements imposed by the Act on Financial Market Supervision, i.e. have share capital paid in cash, min. PLN 200,000. Otherwise, they are subject to imprisonment for up to two years and a fine of up to PLN 500,000.

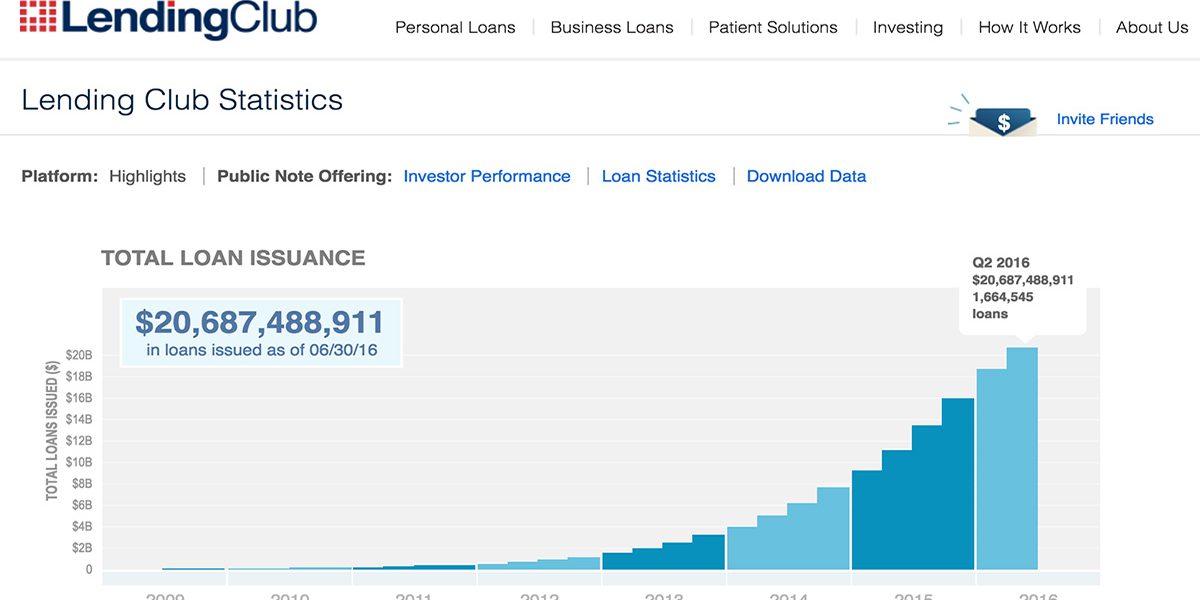

A good example of how the state and the regulator should act at the time of innovation is Great Britain, which in 2014 was the first to introduce regulations conducive to the development of social loans. As a result, the 3 largest P2P loan companies significantly accelerated their development and over 20 new companies were established in this sector! There are already 8 large (each with a capitalization of more than $ 1 billion) social lending platforms in the United States, the largest of which, www.lendingclub.com, has lent more than $ 20 billion to date and is growing at the following rate:

The UK and US governments have long recognized that it is worth supporting the development of the collaborative economy, as it contributes, inter alia, to to a more efficient allocation of resources in the economy. Currently, in Poland, it is only up to the regulator whether the P2P lending market will develop. Polish innovative companies from the social loan sector are waiting for business development opportunities in our country. I am convinced that if the regulations in Poland do not change, Poles will find a way to “exchange” their money with each other, but they will be forced to use English or American platforms and they will pay taxes in those countries. The world of finance is heading towards P2P loans, the question is whether we will manage to change the regulations in Poland so that domestic companies are created before global players enter our market.

Cheers,

LSZ