Regulators must innovate so that the economy is not left behind

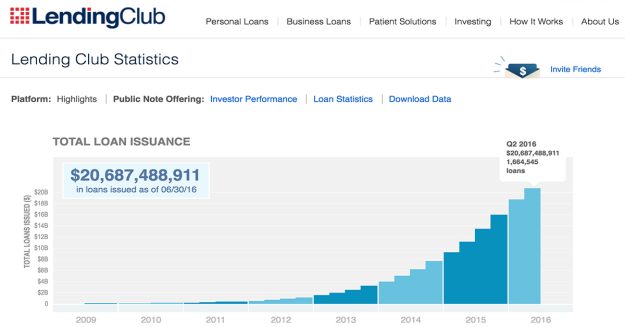

Collaborative economy business models know no boundaries, especially in the financial industry and its technological branch – fintech. In addition to the increasingly popular services such as crowdfunding, equity crowdfunding, social currency exchange and cryptocurrencies (Bitcoin), P2P money lending, i.e. social loans, is dynamically developing. Social lending, otherwise known as peer-to-peer lending, is developing very…